- The Investor Lookout

- Posts

- 📈 WM's Waste-to-Wealth Play

📈 WM's Waste-to-Wealth Play

Trump Strikes EU Trade Deal, Allianz Customers Hit by Hack, Zuckerberg Hires OpenAI Chief Scientist, Tesla Inks $16.5B Samsung Deal, UnitedHealth Profits Plunge, DOJ Probes

Good morning.

⚡ The Fast Five → Trump Strikes EU Trade Deal, Allianz Customers Hit by Hack, Zuckerberg Hires OpenAI Chief Scientist, Tesla Inks $16.5B Samsung Deal, UnitedHealth Profits Plunge, DOJ Probes

🔎 Market Trends → S&P 500, Nasdaq close at records; Deckers soars on UGG demand; US Futures Slightly Higher

And now…

⏱️ Your 5-minute briefing for Monday, July 28, 2025:

MARKET BRIEF

Before the Open

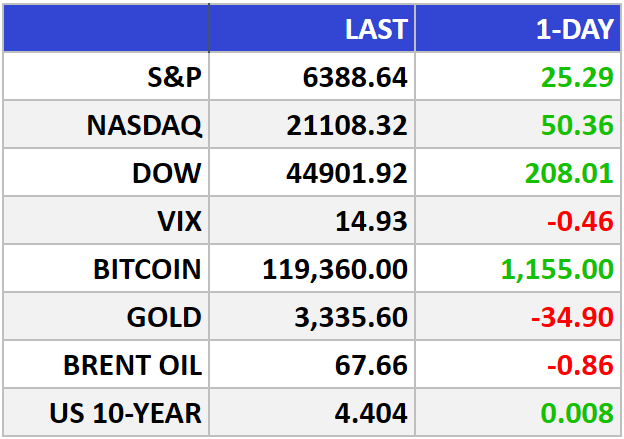

As of market close 07/25/2025.

Pre-Market

|

|

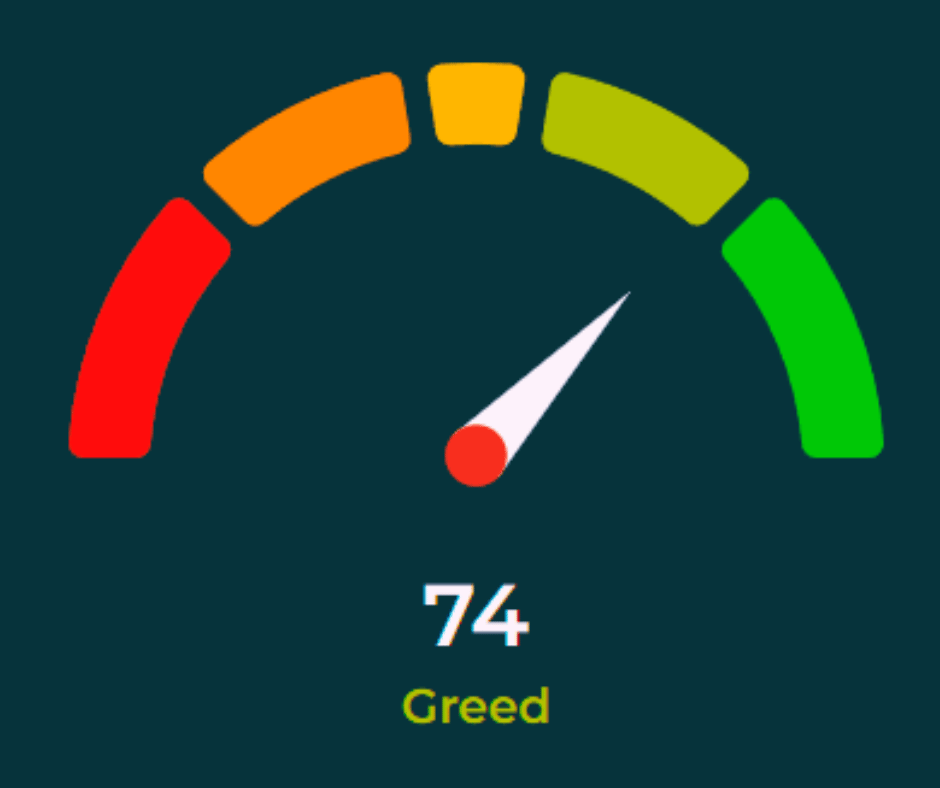

Fear & Greed

Markets in Review

S&P 500 Scores 5th Straight Record: Bulls Charge Into Earnings Week

The S&P 500 rose 0.4% to 6,388.6, logging its 14th record close of 2025. The Nasdaq climbed 0.24% to 21,108.3, marking its 15th record close this year, while the Dow gained 208 points to 44,901.9, just shy of its all-time high.

The Big Picture:

The bull market isn’t just alive—it’s thriving. A potent mix of blowout earnings and trade deal momentum has sent U.S. stocks into uncharted territory, with all three major indices finishing the week in the green.

More than 82% of S&P 500 companies reporting have topped expectations, per FactSet. Add to that President Trump’s string of trade agreements—with Japan locked in and EU talks brewing—and risk appetite remains strong despite looming tariff deadlines.

Market breadth is widening. Inflation is stable, rates are anchored, and earnings are trending higher, setting the stage for continued upside.

Market Movers:

Alphabet (GOOG): Q2 earnings crushed estimates, driving a 4% gain this week—proof that AI tailwinds are still blowing hard.

Verizon (VZ): Jumped 5% on a surprise earnings beat, showing old-line telecoms still have juice.

Trade Deals: Japan’s 15% reciprocal tariff pact and a pending EU agreement bolster sentiment ahead of the Aug. 1 deadline.

What They’re Saying:

“The bull market lives on, supported largely by favorable fundamentals… earnings are trending higher, and that presents a favorable backdrop for stocks to trend higher.”— Terry Sandven, U.S. Bank Wealth Management

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Waste Management, The Hartford (Hartford Insurance Group)

Tomorrow: Visa, Procter & Gamble, UnitedHealth Group, Starbucks, PayPal, UPS, Boeing, Booking.com, Spotify, Royal Caribbean, Electronic Arts (EA)

MARKET BRIEF

Leading News

Trash Talk: Waste Management's Q2 Could Signal Sweet Spot for Investors

Photo Credit: AP Photo/David J. Phillip

Why it matters:

WM reports earnings today after close, with analysts eyeing $1.89 EPS (+3.8% YoY) as proof that boring businesses can deliver sexy returns in volatile times.

Zoom Out:

The garbage game isn't glamorous, but it's recession-proof gold. Waste Management (WM) sits pretty with pricing power that would make Netflix jealous—long-term contracts with built-in escalators mean steady cash even when markets tank.

The Stericycle acquisition is the real kicker here. Adding medical waste disposal to WM's empire creates a defensive moat wider than most landfills. Healthcare waste doesn't disappear during downturns; it multiplies.

Key Insights:

Revenue surge: Projected $6.36B (+17.8% YoY) driven by collection volumes up 18% and recycling gains of 15%—the circular economy isn't just virtue signaling anymore

Green machine: Over 100 renewable natural gas plants converting landfill methane into revenue streams, capitalizing on carbon credit markets before they get crowded

Margin magic: EBITDA holding steady at 29-30% despite inflation, proving operational leverage in an essential service

Market Pulse:

"WM trades like a utility but grows like tech—that's the sweet spot for 2025," notes Oppenheimer's Noah Kaye, who just bumped his target to $260.

Bull’s Take:

With $3.5-4B in projected free cash flow and debt reduction targets on track, WM is positioned to restart buybacks while riding the ESG wave. At $234 pre-market, there's still 7% upside to analyst targets—not bad for taking out the trash.

Headlines

Trump announces EU trade deal with 15% tariffs (link)

Allianz Life says majority of US customers' data stolen in hack (link)

Roche to test if new drug can prevent Alzheimer’s disease (link)

Mark Zuckerberg Names OpenAI Veteran Shengjia Zhao As Chief Scientist Of Meta Superintelligence Labs (link)

Tesla signs $16.5bn Samsung semiconductor chips deal (link)

UnitedHealth aims to reassure investors as profits plunge, DOJ investigates its Medicare business (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to HighyieldHarry

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply