- The Investor Lookout

- Posts

- 📈 Visa Beats, Market Retreats

📈 Visa Beats, Market Retreats

Palo Alto Eyes $20B CyberArk, Union Pacific Buys Norfolk $85B, Nvidia Hits $4.3T on China, Mars Invests $2B in Manufacturing, Anthropic Raises at $170B Valuation

Good morning.

⚡ The Fast Five → Palo Alto Eyes $20B CyberArk, Union Pacific Buys Norfolk $85B, Nvidia Hits $4.3T on China, Mars Invests $2B in Manufacturing, Anthropic Raises at $170B Valuation

🔎 Market Trends → Equities close lower as earnings weigh; Fed statement on tap; US Futures Steady After Mixed Wall Street Session

And now…

⏱️ Your 5-minute briefing for Wednesday, July 30, 2025:

MARKET BRIEF

Before the Open

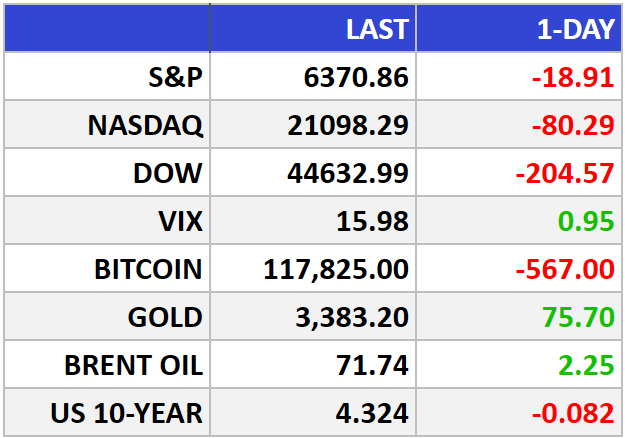

As of market close 07/29/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Futures Steady as Wall Street Holds Breath for Fed Decision

U.S. stock futures hovered flat Tuesday night after the S&P 500 ended a six-day record streak, slipping 0.3%. The Dow lost 0.5%, and the Nasdaq fell 0.4% as trade jitters with China resurfaced.

The Big Picture:

Markets hit pause as investors digest mixed earnings and await the Fed’s rate call. With futures pricing a 98% chance of no rate change, the focus shifts to Jerome Powell’s tone at Wednesday’s press conference—will he hint at cuts later this year, or stay hawkish?

Trade remains the wild card. U.S. negotiators left talks with Beijing without confirming an extension of the tariff pause. Any signal from President Trump before the Aug. 1 deadline could swing sentiment sharply.

Earnings season continues to underpin optimism. Over 80% of S&P 500 companies have topped estimates so far, keeping the broader market resilient despite geopolitical noise.

Market Movers:

Starbucks (SBUX): Shares jumped 3%+ postmarket after Q3 revenue beat expectations, proving consumer demand is holding despite macro pressures.

Visa (V): Fell 2% even with strong results—investors fear higher rates and tariffs could weigh on cross-border spending.

Tech Watch: Wednesday brings heavy hitters Meta (META) and Microsoft (MSFT)—their results could reignite the rally.

What They’re Saying:

“Despite increased political scrutiny, Fed Chair Jerome Powell continues to signal patience… Markets don’t expect policy shifts until at least September.” — Jerry Tempelman, Mutual of America Capital Management

WHAT WE’RE WATCHING

Events

Today: Automatic Data Processing, Inc - Automatic Data Processing, Inc. (ADP) Non-Farm Employment Change - 8:15am

Why You Should Care: Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity;

Today: Bureau of Economic Analysis - Advance Gross Domestic Product (GDP) q/q - 8:15am

Why You Should Care: It's the broadest measure of economic activity and the primary gauge of the economy's health;

Today: Federal Reserve - Federal Funds Rate - 2:00pm

Why You Should Care: Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future;

Today: Federal Reserve - Federal Open Market Committee (FOMC) Statement - 2:00pm

Why You Should Care: It's the primary tool the FOMC uses to communicate with investors about monetary policy. It contains the outcome of their vote on interest rates and other policy measures, along with commentary about the economic conditions that influenced their votes. Most importantly, it discusses the economic outlook and offers clues on the outcome of future votes;

Today: Federal Reserve - Federal Open Market Committee (FOMC) Press Conference - 2:30pm

Why You Should Care: It's among the primary methods the Fed uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, along with commentary about economic conditions such as the future growth outlook and inflation. Most importantly, it provides clues regarding future monetary policy;

Earnings Reports

Today: Microsoft, Meta (Facebook, Instagram, WhatsApp), Ford Motor Company, Allstate, Robinhood, Carvana, Qualcomm, HSBC

Tomorrow: Apple, Amazon, Mastercard, Unilever, Anheuser-Busch InBev (Budweiser), Comcast, Ferrari, CVS Health, Coinbase, S&P Global, Sanofi, MicroStrategy, Roblox

MARKET BRIEF

Leading News

Visa's Steady Beat Shows Consumer Wallets Still Open—Despite Wall Street's Cold Shoulder

Photo Credit: Aleksandrs Karev

Why it matters:

The payments giant's 8% profit jump to $5.3 billion signals that American spending habits remain remarkably durable, even as investors demand perfection in an uncertain economy.

Zoom Out:

Visa (V) delivered another quarter of what behavioral economists call "boring excellence"—the kind of predictable growth that markets often punish in the short term but reward handsomely over decades. Revenue climbed 14% to $10.2 billion, driven by an 8% rise in global payments volume.

The stock's 2.6% after-hours tumble reveals more about investor psychology than corporate fundamentals. Wall Street's disappointment stemmed not from weakness but from Visa's refusal to raise full-year guidance—a classic case of the market punishing prudence.

This pattern echoes across the payments ecosystem, where American Express and PayPal also saw shares decline despite beating estimates. When unemployment sits at 4.1%, as JPMorgan's CFO noted, consumer resilience shouldn't surprise anyone.

Key Insights:

The Network Effect Advantage: Visa's $2.98 adjusted EPS (vs. $2.85 expected) demonstrates the power of operating the world's largest payments network. Each transaction generates incremental profit with minimal additional cost—a moat Warren Buffett would appreciate.

Cross-Border Momentum: International volumes jumped 10% while domestic grew 7%, suggesting both travel recovery and global commerce normalization continue benefiting the franchise.

Conservative Guidance = Smart Capital Allocation: Management's unchanged outlook for "low double-digit" revenue growth reflects disciplined expectations, not deteriorating prospects.

Market Pulse:

"In a world with a 4.1% unemployment rate, it's just going to be hard to see a lot of weakness," —JPMorgan CFO Jeremy Barnum

Bull’s Take:

Visa's stumble after solid results exemplifies why patient investors often outperform reactive traders. The company's 12% year-to-date gain already outpaces the S&P 500's 9% advance—and the underlying consumer spending trends remain intact for those willing to look past quarterly noise.

Headlines

Palo Alto Eyes CyberArk in $20 Billion Cybersecurity Deal (link)

Union Pacific to buy Norfolk in $85 billion mega U.S. railroad deal (link)

Nvidia Hits $4.3 Trillion Market Cap on China Chip Orders (link)

Starbucks same-store sales fall again, but CEO Niccol says turnaround is ahead of schedule (link)

Candy giant Mars to invest $2 billion more in U.S. manufacturing through 2026 (link)

Anthropic in talks to raise fresh capital at $170 billion valuation (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to alifarhat79

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply