- The Investor Lookout

- Posts

- 📈 Merck's $3B Strategic Reset

📈 Merck's $3B Strategic Reset

UnitedHealth's Medical Cost Reality Check, Scale AI Rival Micro1 Hits $500M, JPMorgan Blasts Fintech Data Parasites, Utilities Face $1.1 Trillion Power, Upgrade, Firefly Aerospace Eyes $5.5B Space Bet

Good morning.

⚡ The Fast Five → UnitedHealth's Medical Cost Reality Check, Scale AI Rival Micro1 Hits $500M, JPMorgan Blasts Fintech Data Parasites, Utilities Face $1.1 Trillion Power, Upgrade, Firefly Aerospace Eyes $5.5B Space Bet

🔎 Market Trends → S&P 500, Nasdaq close again at record highs, trade choppy; Wall St futures climb as US–EU deal kicks off pivotal week

And now…

⏱️ Your 5-minute briefing for Tuesday, July 29, 2025:

MARKET BRIEF

Before the Open

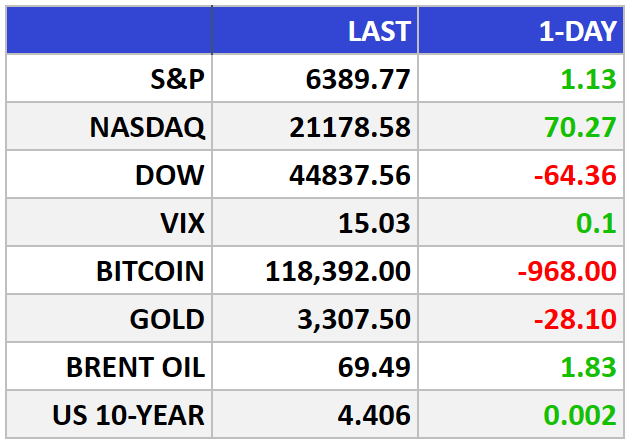

As of market close 07/27/2025.

Pre-Market

|

|

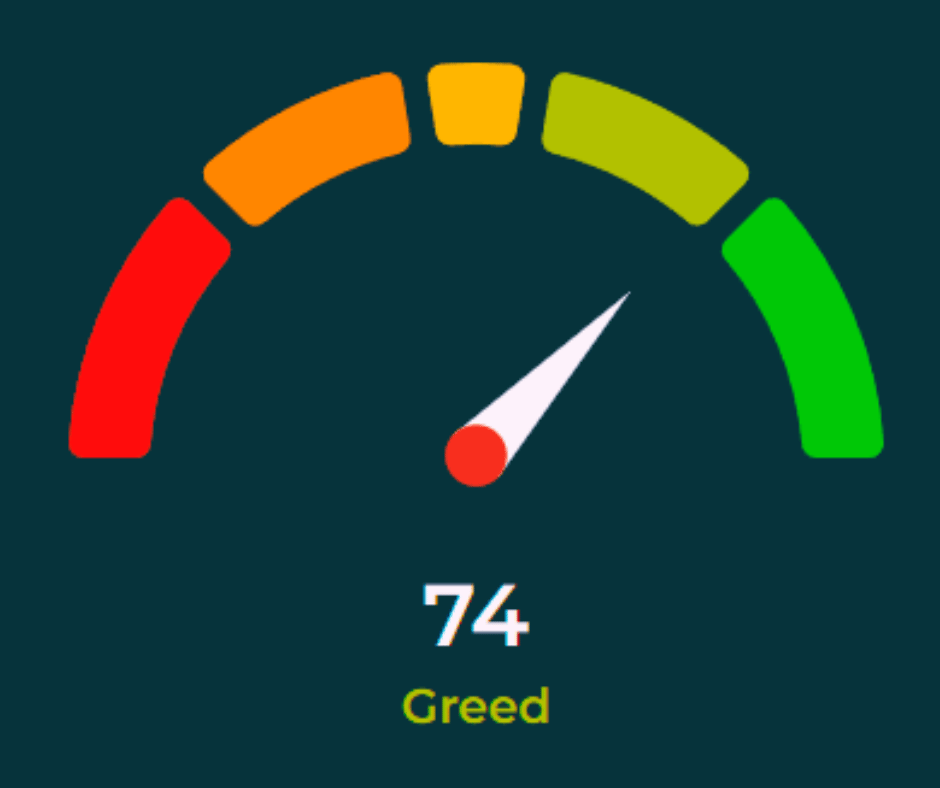

Fear & Greed

Markets in Review

Futures Flat, But Bulls Eye More Highs as Earnings and Fed Loom

The S&P 500 barely nudged higher Monday, closing at yet another record—its 15th of 2025—while the Nasdaq rose 0.3%. The Dow slipped 0.1%. Futures this morning are almost unchanged, hinting at cautious optimism.

The Big Picture:

Markets are treading water, but the bullish undertone remains intact. A U.S.-EU trade deal—15% tariffs on European goods—failed to spark a major rally, yet it removed a layer of uncertainty. Investors are now eyeing potential China trade headlines as the Aug. 1 tariff deadline nears.

The Fed’s policy decision Wednesday could be the week’s real market mover. Expectations: no rate changes, but tone matters. A dovish hint could light the next leg of this rally.

Meanwhile, earnings season is peaking. Over 83% of reporting S&P 500 companies have beaten estimates. This week brings heavyweights Meta (META), Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL)—all capable of shifting sentiment.

Market Movers:

Earnings Leadership: So far, tech and consumer names are doing the heavy lifting, fueling the S&P’s record streak.

Trade Tailwinds: Deals with Japan, Indonesia, and now the EU reinforce a pro-market narrative heading into the tariff deadline.

Macro Watch: JOLTS, ADP, and Friday’s payrolls will test whether the labor market’s soft landing story still holds.

What They’re Saying:

“If we get no surprises in earnings and some dovish comments by the Fed, it’s likely we’ll see yet more new highs by the end of the week.”— Louis Navellier, Navellier & Associates

WHAT WE’RE WATCHING

Events

Today: Bureau of Labor Statistics - Job Openings and Labor Turnover Survey (JOLTS) Job Openings - 10:00am

Why You Should Care: Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity;

Earnings Reports

Today: Visa, Procter & Gamble, UnitedHealth Group, Starbucks, PayPal, UPS, Boeing, Booking.com, Spotify, Royal Caribbean, Electronic Arts (EA)

Tomorrow: Microsoft, Meta (Facebook, Instagram, WhatsApp), Ford Motor Company, Allstate, Robinhood, Carvana, Qualcomm, HSBC

MARKET BRIEF

Leading News

Merck's Strategic Reset: A $3B Bet on Life After Keytruda

Photo Credit: Merck

Why it matters:

Merck (MRK) is making the textbook move of reshuffling the deck chairs while the ship is still sailing smoothly—a $3 billion cost-cutting program that signals both prudent planning and lurking anxiety about 2028's patent cliff.

Zoom Out:

The pharmaceutical giant's preemptive strike against Keytruda's looming patent expiration reveals a management team that understands the cardinal rule of drug development: today's blockbuster is tomorrow's generic. While Wall Street punished shares with a 3% premarket drop, seasoned investors should recognize this as exactly the kind of forward-thinking capital allocation that separates winners from also-rans.

Merck's quarterly stumble—missing revenue estimates for the first time since 2021—reflects temporary headwinds rather than structural decay. The $649 million restructuring charge stung earnings, but this is the necessary medicine before the cure.

The company's China troubles with Gardasil (HPV vaccine sales plunged 55%) underscore geopolitical risks that smart money has already priced in. Meanwhile, newer drug Winrevair delivered $336 million in sales, beating estimates and validating the pipeline strategy.

Key Insights:

Patent cliff preparation: CEO Rob Davis frames Keytruda's 2028 expiration as "more of a hill than a cliff"—the kind of confidence that comes from watching competitors stumble through similar transitions

Manufacturing reshoring: Trump's pharma tariffs are forcing a $200 million hit but accelerating domestic production investments that could pay dividends beyond the current trade cycle

Pipeline momentum: The $1.7 billion in annual savings by 2027 gets plowed directly into R&D and launches—classic reinvestment playbook from a company that knows innovation pays the bills

Market Pulse:

"Today, we announced a multiyear optimization initiative that will redirect investment and resources from more mature areas of our business to our burgeoning array of new growth drivers," CEO Rob Davis said—corporate speak that translates to "we're not waiting for the cliff to jump."

Bull’s Take:

Merck's proactive restructuring resembles a chess master sacrificing pawns to protect the king. Smart investors should view this temporary earnings drag as the price of admission to pharma's next growth chapter.

Headlines

UnitedHealth says 2025 earnings will be worse than expected as high medical costs dog insurers (link)

Scale AI competitor Micro1 raising funds at $500 million valuation (link)

Warner Bros. Discovery announces post-split companies will be ‘Warner Bros.’ and ‘Discovery Global’ (link)

JPMorgan says fintech middlemen like Plaid are ‘massively taxing’ its systems with unnecessary pings (link)

Electric Utilities Will Invest More Than $1.1 Trillion By 2030 To Meet Demand Growth (link)

PE-backed Firefly Aerospace seeks $5.5B+ IPO valuation as space tech heats up (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to wallstmemes

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply