- The Investor Lookout

- Posts

- 📈 McGraw Hill's $415M IPO

📈 McGraw Hill's $415M IPO

Alphabet Revenue Up 14%, Chipotle Stock Tumbles 9%, ServiceNow Lifts AI Guidance, Tesla Profits Slide 16%, Waystar Buys Iodine $1.25B

Good morning.

⚡ The Fast Five → Alphabet Revenue Up 14%, Chipotle Stock Tumbles 9%, ServiceNow Lifts AI Guidance, Tesla Profits Slide 16%, Waystar Buys Iodine $1.25B

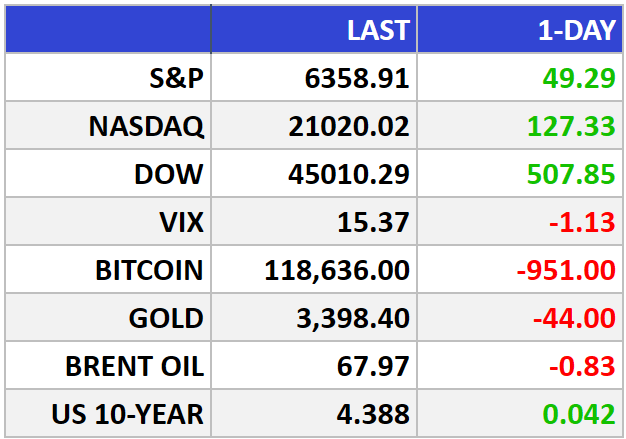

🔎 Market Trends → S&P 500, Nasdaq rally to record highs on optimism about trade deals; US Futures Surge on Positive Trade Developments

And now…

⏱️ Your 5-minute briefing for Thursday, July 24, 2025:

MARKET BRIEF

Before the Open

As of market close 07/23/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Trade Winds, Tater Wins: S&P Hits Fresh High as Deal Hopes Sizzle

The S&P 500 rose 0.8% to 6,358.9, marking a third straight record close, while the Dow Jones Industrial Average surged 1.1% to 45,010.3. The Nasdaq gained 0.6% to 21,020. Risk-on sentiment ruled, with all but two sectors in the green.

The Big Picture:

Markets cheered renewed trade momentum, as President Trump announced a sweeping $550B investment deal with Japan, plus growing chatter around pending agreements with the EU and Korea. Investors read it as a bullish pivot—Trump's back in dealmaking mode after weeks of tariff saber-rattling.

Sector rotation lit up the screen, with health care leading gains, joined by upbeat earnings from key players like Thermo Fisher (TMO) and Lamb Weston (LW). The rally came despite weak existing home sales and a miss from chip giant Texas Instruments (TXN), suggesting equities may be climbing the proverbial wall of worry.

Oil ticked up slightly (+0.2% to $65.43) as US crude and gasoline inventories shrank. Meanwhile, gold dropped 1.3% to $3,399.4 per troy ounce as investor appetite tilted risk-on.

Market Movers:

Lamb Weston (LW) +16.3%: Mashed expectations with a strong Q4 and announced a cost-cutting drive—a recipe Wall Street loves.

Thermo Fisher (TMO) +9.1%: Blew past estimates and hiked guidance, validating bets on medical diagnostics strength.

Texas Instruments (TXN) -13.3%: Issued soft Q3 guidance, spooked by tariffs and geopolitical headwinds. A casualty of uncertainty in chips.

What They’re Saying:

“If Trump has, in fact, loosened up on dealmaking, the set-up is better for other deals too.”— Macquarie strategists Thierry Wizman and Gareth Berry

WHAT WE’RE WATCHING

Events

Today: Department of Labor - Unemployment Claims - 8:30am

Why You Should Care: Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

Today: S&P Global - Flash Manufacturing Purchasing Managers' Index (PMI); Flash Services PMI - 9:45am

Why You Should Care: It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy;

Earnings Reports

Today: Intel, Keurig Dr Pepper, Blackstone, Nasdaq, Honeywell, Vodafone, Deutsche Bank, Union Pacific, Valero

Tomorrow: Charter Communications (Spectrum), Phillips 66, AutoNation, Aon, HCA Healthcare

MARKET BRIEF

Leading News

McGraw Hill's $415M IPO: Education Giant Returns After 13-Year Private Hiatus

Photo Credit: Boston Valley Terra Cotta

Why it matters:

The textbook titan's public return signals PE exit momentum is accelerating, while education stocks get a fresh catalyst amid ongoing digitization trends.

Zoom Out:

McGraw Hill (MHE) priced its comeback IPO at $17 per share—below the $19-$22 range—raising $415 million and valuing the education publisher at $3.25 billion. Platinum Equity retains an 84.6% stake, suggesting confidence in long-term prospects.

The timing capitalizes on a hot IPO window that's finally opening after years of private equity sponsors sitting on exit-ready portfolio companies. With equity markets rallying and recent debuts performing well, PE firms are rushing to monetize.

This isn't McGraw's first rodeo—Apollo took it private in 2012, attempted a 2015 re-listing, then sold to Platinum. Now it's back, armed with $2+ billion revenue (up 7% annually) and an 82% market share in U.S. higher education.

Key Insights:

Defensive moat play: Textbook publishers enjoy sticky customer relationships and recurring revenue streams—exactly what income-focused investors crave in uncertain times

Digital transformation upside: Traditional publishers pivoting to digital learning platforms could see margin expansion as physical printing costs decline

Demographic tailwinds: Rising college enrollment and corporate training budgets create secular growth drivers for educational content

Market Pulse:

"The IPO market is gaining momentum on the back of a rally in equities and some stellar debuts" — Market observers betting on sustained deal flow

Bull’s Take:

Education is recession-resistant with predictable cash flows, and McGraw's dominant market position offers both dividend potential and EdTech transformation upside. Smart money follows the PE playbook here.

Headlines

Alphabet Posts 14% Revenue Gain, Raises AI-Driven CapEx to $85 Billion (link)

Chipotle stock tumbles 9% after chain cuts same-store sales forecast (link)

ServiceNow lifts guidance on AI growth (link)

Tesla profits slide 16%, despite Elon Musk's pivot back to his companies (link)

Waystar to buy Iodine Software in $1.25 billion deal to boost AI in healthcare payments (link)

Neuralink targets $1 billion revenue by 2031 (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to wallstmemes

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply