- The Investor Lookout

- Posts

- 📈 JPMorgan Leads Banking's Moment of Truth

📈 JPMorgan Leads Banking's Moment of Truth

Nvidia Resumes China AI Sales, Meta's AI Data Center Billions, Cognition Buys Windsurf After Google, MicroStrategy Bitcoin Holdings Hit 600K, Trade Desk Joins S&P 500

Good morning.

⚡ The Fast Five → Nvidia Resumes China AI Sales, Meta's AI Data Center Billions, Cognition Buys Windsurf After Google, MicroStrategy Bitcoin Holdings Hit 600K, Trade Desk Joins S&P 500

🔎 Market Trends → Wall St ends modestly higher ahead of earnings, economic data; US Futures Point to Lower Open

And now…

⏱️ Your 5-minute briefing for Tuesday, July 15, 2025:

MARKET BRIEF

Before the Open

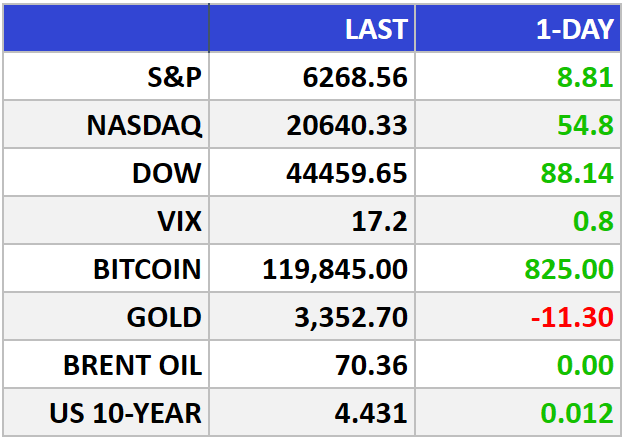

As of market close 07/14/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Nasdaq Hits New High as Wall Street Shrugs Off Tariff Heat

Nasdaq rose 0.3% to 20,640.3, notching a fresh record close. S&P 500 edged up 0.1% to 6,268.6, while the Dow gained 0.2% to 44,459.7.

The Big Picture:

Wall Street continues to climb the tariff wall, with investors brushing off escalating trade rhetoric from President Trump. Despite threats of 30%–100% tariffs on Russia, the EU, and Mexico, investors stayed focused on earnings season and macro fundamentals.

The market's mood? Cautiously bullish. Traders appear to believe that Trump’s tariff threats are political theater, not economic suicide. As second-quarter earnings kick off, expectations are for modest S&P 500 growth, even with tariff pressures factored in.

Commodities blinked. West Texas Intermediate crude dipped 2.2% to $66.97, as traders weighed global demand against geopolitical risks. Gold fell 0.3% to $3,354.2, with silver down 1.2%—a mild risk-on signal.

Market Movers:

Veritex (VBTX) +20%: Surged after being acquired by Huntington Bancshares (HBAN) in a $1.9B all-stock deal. Huntington dipped 1.8%, as the market digested integration risk.

Waters (WAT) -14%: Tanked after agreeing to a $17.5B merger with Becton Dickinson (BDX). Investors balked at the price tag.

Autodesk (ADSK) +5.1%: Popped after walking away from a potential PTC merger. Sometimes, doing nothing wins.

What They’re Saying:

“There’s a more ominous possibility that Trump is no longer using tariffs for leverage, but for revenue.”— Macquarie, client note

WHAT WE’RE WATCHING

Events

Today: Bureau of Labor Statistics - Core Consumer Price Index (CPI) Ex Food and Energy m/m; Consumer Price Index (CPI) m/m; Consumer Price Index (CPI) y/y - 8:30am

Why You Should Care: Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate;

Earnings Reports

Today: J.P. Morgan Chase, Wells Fargo, BlackRock, Citigroup, The Bank of New York, State Street, Albertsons, Ericsson

Tomorrow : Johnson & Johnson, Bank of America, United Airlines, ASML, Morgan Stanley, Goldman Sachs, Progressive, Prologis, PNC, Kinder Morgan, M&T Bank

MARKET BRIEF

Leading News

JPMorgan's Q2 Earnings: A Bellwether for Banking's Trump-Era Revival

Photo Credit: Frugal Flyer

Why it matters:

The nation's largest bank reports Tuesday with Wall Street expecting $4.48 per share on $44.16 billion in revenue—a litmus test for whether financial stocks' 14.4% rally this quarter has fundamental legs.

Zoom Out:

JPMorgan Chase (JPM) has become the banking sector's North Star, and Tuesday's pre-market earnings will reveal whether the post-election euphoria around financial deregulation translates into actual profit growth. The behavioral finance lesson here is classic: investors often extrapolate recent trends too far, but sometimes those trends reflect genuine structural shifts.

President Trump's trade volatility has paradoxically boosted trading desks—the kind of counterintuitive market dynamic that separates sophisticated investors from the crowd. Meanwhile, robust employment levels have kept credit losses manageable, though the prudent investor remembers that loan losses are lagging indicators.

Key Insights:

Trading revenue surge: Fixed income trading expected at $5.2 billion versus equities at $3.2 billion—volatility remains a profit center for banks with scale

Wealth management tailwinds: High asset levels benefit fee-based businesses, a recurring revenue stream that Warren Buffett would appreciate

Credit quality watch: Employment strength has delayed the inevitable credit cycle, but smart money monitors provision expenses closely

Market Pulse:

"The Wall Street side of these firms has been providing outsized returns lately," notes Northwestern Mutual's Matt Stucky, though he wisely tempers expectations around investment banking recovery.

Bull’s Take:

JPMorgan's diversified revenue streams and fortress balance sheet position it to capitalize on both market volatility and potential deregulation. The stock's recent strength reflects genuine earnings power, not just sentiment.

Headlines

Nvidia says it will resume H20 AI chip sales to China ‘soon,’ following U.S. government assurances (link)

Meta Pledges Hundreds of Billions to AI Data Centers Starting 2026 (link)

Cognition to buy AI startup Windsurf days after Google poached CEO in $2.4 billion licensing deal (link)

MicroStrategy’s stock surges as bitcoin purchases resume, lifting holdings to above 600,000 (link)

Trump to unveil $70 billion in AI and energy investments (link)

Trade Desk’s stock jumps on S&P 500 inclusion as Ansys exits index due to acquisition (link)

CRYPTO

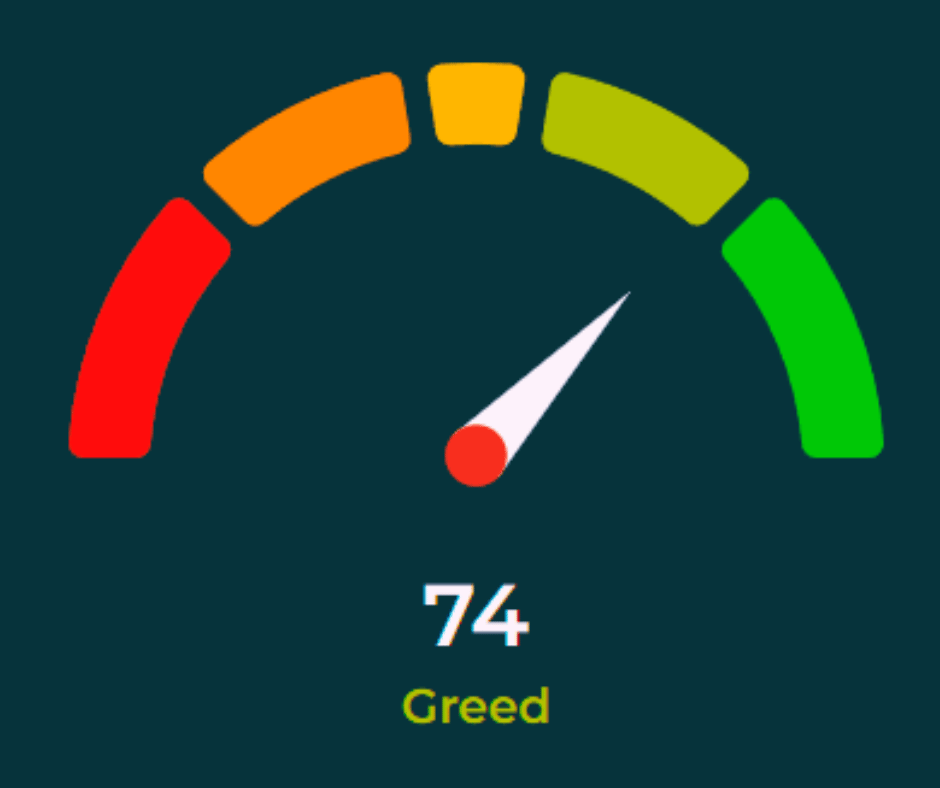

Fear & Greed

Headlines

*Hat-tip to crediblefin

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply