- The Investor Lookout

- Posts

- 📈 Intel's CEO Kills Sacred Cows

📈 Intel's CEO Kills Sacred Cows

FCC Blesses Paramount-Skydance Deal, Meme Stocks Stage Surprise Comeback, Tesla Tumbles on Musk Warning, Sony-Honda Merges AI, Auto Dreams, Deckers Outdoor Soars on Earnings

Good morning.

⚡ The Fast Five → FCC Blesses Paramount-Skydance Deal, Meme Stocks Stage Surprise Comeback, Tesla Tumbles on Musk Warning, Sony-Honda Merges AI, Auto Dreams, Deckers Outdoor Soars on Earnings

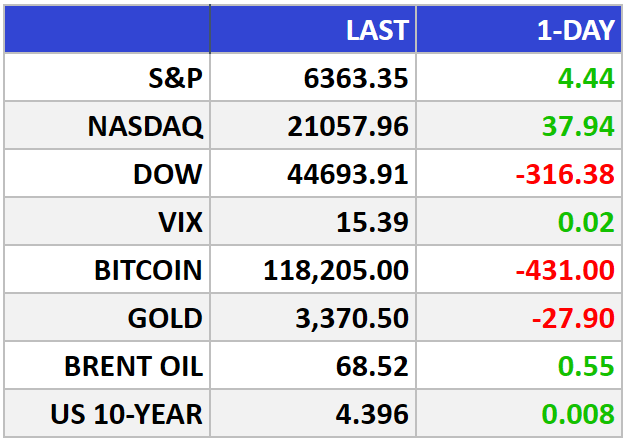

🔎 Market Trends → S&P 500 and Nasdaq notch record closes, lifted by Alphabet; US Futures Hold Muted Momentum

And now…

⏱️ Your 5-minute briefing for Friday, July 25, 2025:

MARKET BRIEF

Before the Open

As of market close 07/24/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Futures Drift Up as Market Awaits Final Tariff Punch, Fed Pause

The S&P 500 and Nasdaq clinched fresh record closes on Thursday, buoyed by strong earnings and trade optimism. Futures edged higher in the evening session, with S&P 500 futures up 0.16%, Nasdaq 100 +0.12%, and Dow futures climbing 78 points (+0.17%).

The Big Picture:

Wall Street is coasting on a wave of solid earnings beats and tariff détente. With over 83% of S&P 500 companies surpassing earnings expectations, the market is finding fuel not just from the usual tech suspects, but from broader participation.

The S&P 500 notched its 13th record close of 2025, while the Nasdaq smashed past 21,000 for the first time midweek. Even the Dow is tracking a 1% weekly gain, showing the rally’s reach beyond high-flying tech.

Much of the current optimism stems from recent Trump-era trade wins. Deals with Japan and Indonesia—both agreeing to new “reciprocal” tariffs—are easing geopolitical tension just ahead of the Aug. 1 tariff enforcement deadline.

Market Movers:

Alphabet (GOOG): Strong Q2 beat boosted sentiment—proof that AI ad spend and cloud business continue to drive growth.

Broad-based buying: With nearly every S&P 500 sector participating, breadth is improving, a key indicator of rally sustainability.

Fed Watch: Markets expect no rate change at next week’s FOMC, but Trump’s latest pressure on Powell adds intrigue, not volatility—for now.

What They’re Saying:

“This part of the rally has to broaden out... to keep going another leg higher.” — Keith Buchanan, Globalt Investments

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Charter Communications (Spectrum), Phillips 66, AutoNation, Aon, HCA Healthcare

Monday: Waste Management, The Hartford (Hartford Insurance Group)

MARKET BRIEF

Leading News

Intel's New Sheriff Shoots Down Sacred Cows—And Stock Soars

Photo Credit: Rubaital Azad

Why it matters:

New CEO Lip-Bu Tan's ruthless cost-cutting and foundry pullback signals Intel (INTC) may finally be prioritizing profits over pipe dreams.

Zoom Out:

The chipmaker's revenue beat of $12.86 billion versus $11.92 billion expected reveals something curious: Intel's core business remains resilient even as Wall Street had written its obituary. Tan's first major earnings call delivered the kind of brutal honesty investors haven't heard from Intel leadership in years.

His employee memo reads like a confession: "Over the past several years, the company invested too much, too soon—without adequate demand." Translation: Intel's previous management burned cash building factories for customers that didn't exist. Classic behavioral finance trap—overconfidence bias meets sunk cost fallacy.

The 15% workforce reduction and $17 billion expense cut target for 2025 suggests Tan understands what value investors have long preached: sometimes the best investment is the one you don't make.

Key Insights:

Foundry Reality Check: The $3.17 billion operating loss on $4.4 billion foundry revenue exposes Intel's manufacturing-for-hire fantasy. Canceling German and Polish fabs isn't retreat—it's strategic focus.

Market Share Math: Data center revenue up 4% to $3.9 billion while AMD gains ground creates an interesting dynamic. Intel's installed base remains massive; the question is execution speed.

Balance Sheet Discipline: "No more blank checks" signals a CEO who grasps opportunity cost—every dollar spent on speculative capacity is a dollar not returned to shareholders.

Market Pulse:

"Every investment must make economic sense," Tan wrote, channeling Warren Buffett's capital allocation philosophy.

Bull’s Take:

Intel's 13% year-to-date gain reflects early confidence in Tan's turnaround strategy. For patient value investors, a profitable Intel focused on its core strengths beats a cash-burning Intel chasing every shiny object.

Headlines

FCC approves Paramount-Skydance merger (link)

Amazon Unveils AI-Driven Retail ‘Super Agents’ to Boost Sales (link)

Meme Stock Mania Returns With Krispy Kreme and Opendoor Rally (link)

Tesla Shares Fall More Than 8% After Elon Musk Warns Of "Rough Quarters" Ahead (link)

Sony-Honda using AI to advance self-driving and entertainment (link)

HOKA, UGG Parent Deckers Outdoor Stock Rallies 15% After Q1 Report (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to wallstmemes

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply