- The Investor Lookout

- Posts

- 📈 HealthEquity's Earnings Test

📈 HealthEquity's Earnings Test

With $0.85 per share expected and 33% analyst upside targets, this report tests whether execution beats competition in America's hottest benefits niche.

Good Morning…

When healthcare costs rise and tax breaks beckon, smart money follows the trail to companies that profit from both—and Tuesday's HealthEquity earnings could reveal whether this HSA kingpin still deserves its throne.

🔎 Market Trends → Wall Street ends lower as Dell and Nvidia drop

🖥️ Market Movers from Fintech.tv → [WATCH] The interconnectedness of global markets, and the rise of alternative investments

And now…

⏱️ Your 5-minute briefing for Tuesday, September 2, 2025:

MARKET BRIEF

Before the Open

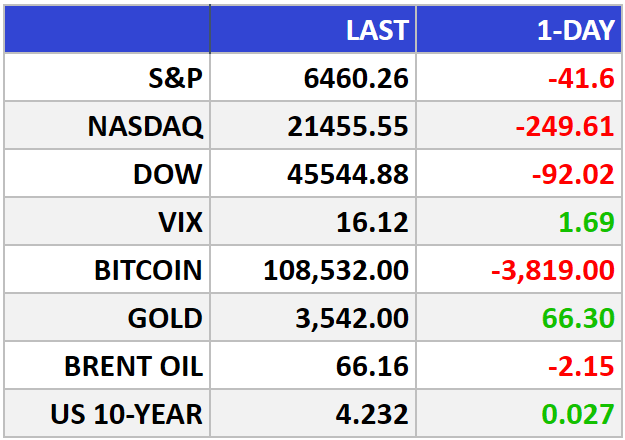

As of market close 08/29/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Tariff Twist, Calm Tape: Bulls Still Hold the Ball

Futures to kick off September were slightly higher: Dow +0.1%, S&P 500 +0.1%, Nasdaq 100 +0.1%—a muted open after August’s gains.

The Big Picture:

A federal appeals court said most of President Trump’s global tariffs are illegal, shifting power back to Congress. Translation: the risk of a broad tariff spiral may fade over time—even if headlines get noisy in the near term.

Seasonality isn’t your friend in September, but momentum is: the S&P 500 has risen four straight months. With Friday’s jobs report looming and a mid-month Fed decision in sight, the market is pricing easing risk, not crisis.

Commodities: crude is steady, keeping energy margins supported while easing fears of an inflation flare. A softer U.S. dollar on tariff uncertainty would be a tailwind for multinationals and commodity producers.

Market Movers:

Tariff-sensitive cyclicals: Industrials with global exposure—think Caterpillar (CAT), Deere (DE)—benefit if reciprocal tariffs are curbed; procurement and FX headwinds ease.

Supply chains & mega-caps: Less tariff overhang is constructive for Apple (AAPL) and hardware peers; near-term noise aside, lower policy risk supports capex visibility into holiday builds.

Small caps & credit: If rate-cut odds firm after payrolls, small caps (IWM) and regional banks (KRE) get relief via cheaper funding and firmer loan demand—even with regulatory and credit caveats.

What They’re Saying:

“A Supreme Court ruling against the use of IEEPA on reciprocal tariffs would reduce the risk of broad-based tariff escalation, which is market-positive… short-term uncertainty may rise as some trade agreements may need to be renegotiated,” wrote Aniket Shah (Jefferies).

WHAT WE’RE WATCHING

Events

There are no events scheduled for today.

Earnings Reports

Today: Zscaler, NIO, Signet Jewelers, Academy Sports + Outdoors

Tomorrow: Macy’s, Campbell’s, American Eagle, Dollar Tree, Salesforce, Hewlett Packard Enterprise, GitLab, Figma

MARKET INSIGHTS

Leading News

HealthEquity's HSA Empire Faces Its Quarterly Reckoning

Photo Credit: JHVEPhoto / Getty Images

Why it matters:

When Americans stash cash in health savings accounts, HealthEquity (HQY) gets paid—and with $0.85 EPS expected Tuesday, this earnings report could validate the company's grip on a growing niche.

Zoom Out:

The beauty of HealthEquity's business model lies in its inevitability. As healthcare costs soar and employers seek tax-advantaged benefits, HSAs become more attractive. The company manages these accounts and earns fees—a predictable revenue stream that grows with account balances and new customers.

Yet 15.04% revenue growth trails peers like Alignment Healthcare's 49%, raising questions about competitive positioning. Still, HealthEquity's 16.3% net margin suggests disciplined execution in a sector where operational efficiency separates winners from also-rans.

The stock's 13.61% annual gain reflects measured optimism, though shares remain 17% below their post-Q4 peak—creating potential upside if management delivers.

Key Insights:

Beat-and-retreat pattern: Last quarter's $0.16 EPS beat sparked an 8.96% rally, but subsequent quarters showed volatility ranging from +9% to -17%

Valuation disconnect: Analysts' $117.44 average price target implies 33% upside, suggesting the market hasn't fully recognized the HSA tailwind

Peer pressure: Despite lowest revenue growth among competitors, HealthEquity leads in return on equity efficiency at 2.54%

Market Pulse:

"HealthEquity sits at the intersection of two unstoppable forces: rising healthcare costs and Americans' desire for tax breaks," notes one analyst tracking the space.

Bull’s Take:

Smart money recognizes that HealthEquity operates in the sweet spot where regulatory tailwinds meet demographic necessity. The HSA market's structural growth, combined with the company's operational discipline, creates a compelling long-term investment thesis—even if quarterly volatility tests investors' resolve.

Market Stories of Note

Nestlé's CEO Shuffle Creates Unlikely Value:

Nestlé's swift dismissal of CEO Laurent Freixe over an undisclosed workplace relationship matters because it demonstrates the Swiss giant's commitment to governance standards that many investors assumed were already priced into the stock. The appointment of coffee veteran Philipp Navratil—a 23-year Nestlé insider who built his reputation managing complex markets from Honduras to Nespresso—suggests continuity over chaos in a company that's weathered far worse storms than executive musical chairs. For patient investors, this governance hiccup may paradoxically strengthen Nestlé's long-term appeal by reinforcing that even the world's largest food company isn't too big to enforce its own rules—a rare trait in today's corporate landscape.

Wegovy's Heart Data Validates Novo's Premium:

New real-world evidence that Novo Nordisk's Wegovy reduces cardiovascular risks 57% more effectively than Eli Lilly's rival drug matters because it transforms a weight-loss product into a genuine heart-disease prevention tool—potentially worth billions in expanded insurance coverage. The Danish giant's ability to prove its semaglutide molecule delivers unique cardiac benefits, rather than just class-wide effects, creates a crucial moat around its premium pricing when competitors are breathing down its neck. For patient investors, this data validates that the GLP-1 revolution isn't just about vanity pounds—it's about life-saving medicine that could justify current valuations even as manufacturing challenges persist.

CRYPTO

Fear & Greed

Headlines

Join 400,000+ executives and professionals who trust The AI Report for daily, practical AI updates.

Built for business—not engineers—this newsletter delivers expert prompts, real-world use cases, and decision-ready insights.

No hype. No jargon. Just results.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply