- The Investor Lookout

- Posts

- 📈 Google Dodges the Breakup Bullet

📈 Google Dodges the Breakup Bullet

Judge Mehta's ruling preserved Google's Chrome browser and data empire while only restricting exclusive search deals, handing investors a rare regulatory victory.

Good Morning…

Google just survived what could have been Silicon Valley's equivalent of Standard Oil's 1911 breakup — and the market's euphoric 6% after-hours surge tells you everything about how much breakup risk was already baked into the stock price.

🔎 Market Trends → Wall Street ends lower as ruling on Trump tariffs raises concerns

🖥️ Market Movers from Fintech.tv → [WATCH] Unlocking the potential of Digital Asset Treasuries with David Namdar

And now…

⏱️ Your 5-minute briefing for Wednesday, September 3, 2025:

MARKET BRIEF

Before the Open

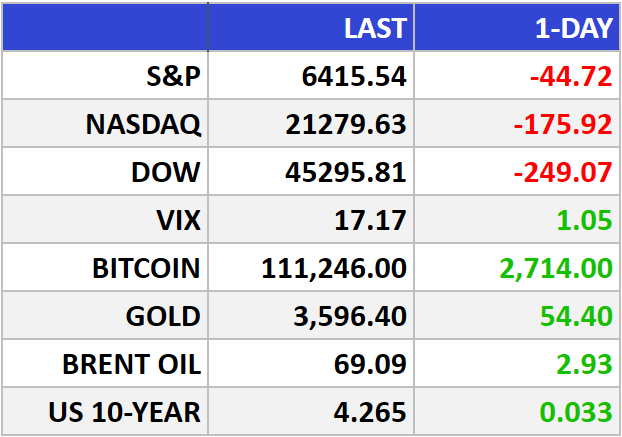

As of market close 09/02/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Yields Bite, Tariff Fog Thickens—But the Bull Case Holds

Stocks slipped to open September: Dow −0.55% (45,295), S&P 500 −0.69% (6,415), Nasdaq −0.82% (21,280). 10-year at 4.27%, 30-year ~5% kept risk appetites in check.

The Big Picture:

A federal appeals court said most of President Trump’s global tariffs are illegal—a legal curveball that raises near-term uncertainty but, longer term, reduces the odds of an all-out tariff spiral. That’s constructive for margins and global supply chains once the dust settles.

Meanwhile, bond markets re-priced fiscal risk; higher long yields raised the equity discount rate, pressuring long-duration tech even as the S&P 500 notched 20 record highs YTD in August. Seasonally, September is tough—but trends and earnings breadth remain favorable if Friday’s jobs report nudges the Fed toward easing.

Commodities: Gold firmed as a safety bid; oil held in a tight range, signaling no fresh inflation impulse from energy—helpful if the Fed wants cover to cut.

Market Movers:

Mega-cap tech mixed: Nvidia (NVDA) −~2%, Apple (AAPL) and Amazon (AMZN) −~1% on higher real yields and profit-taking; NVDA also broke below its 50-DMA, a tactical headwind, not a thesis breaker.

Tariff-sensitive staples: Constellation Brands (STZ) slid on a guide-down as premium beer demand softened—tariff chatter compounds pricing risk.

Idiosyncratic winners: Signet (SIG) +5% on a clean beat/raise; Frontier (ULCC) +13% as it stands to benefit from a rival’s bankruptcy; PepsiCo (PEP) +4% on activist interest—cash-flow moats matter when yields rise.

What They’re Saying:

“Record highs are no reason for concern… we recommend using dips to add exposure,” says UBS’s Ulrike Hoffmann-Burchardi, citing strong earnings and an approaching rate-cut cycle.

WHAT WE’RE WATCHING

Events

Today: Bureau of Labor Statistics - Job Openings and Labor Turnover Survey (JOLTS) - 10:00am

Why You Should Care: Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity;

Earnings Reports

Today: Macy’s, Campbell’s, American Eagle, Dollar Tree, Salesforce, Hewlett Packard Enterprise, GitLab, Figma

Today: Lululemon, National Beverage Corp. (LaCroix), Toro, DocuSign, Broadcom

MARKET INSIGHTS

Leading News

Google Dodges the Breakup Bullet: Chrome Stays, Contracts Go

Photo Credit: Greg Bulla

Why it matters:

Google (GOOGL) avoided the nuclear option of forced asset sales, keeping its Chrome browser while facing only moderate restrictions on exclusive deals — a victory that Wall Street celebrated with a 6% after-hours surge.

Zoom Out:

Judge Amit Mehta's Tuesday ruling represents the classic regulatory middle ground that savvy investors often anticipate but rarely get so cleanly. Rather than dismantling Google's empire, the court essentially said: "You can keep your toys, but you have to share the sandbox."

The decision strikes at Google's $20+ billion annual payments to Apple (AAPL) and other partners for default search placement — the lifeblood of its advertising monopoly. Yet Google retains Chrome and Android, the data-harvesting engines that power its targeted ad machine.

This Goldilocks outcome — not too harsh, not too lenient — suggests regulators understand that breaking up Big Tech might create more problems than it solves, especially with national security implications lurking in the background.

Key Insights:

The Apple Connection: Google's payments to Apple for iPhone default search placement represent one of tech's most lucrative partnerships. With Apple shares jumping 4% after hours, the market clearly believes this revenue stream remains intact despite new restrictions.

Data Sharing Mandate: Google must now share its search data with competitors — potentially creating opportunities for smaller players while diluting Google's informational moat. Think of it as forcing the house to show its cards.

Chrome's Survival: Keeping Chrome means Google maintains its gateway to user behavior data, preserving the feedback loop that makes its ads so valuable to advertisers and its stock so attractive to investors.

Market Pulse:

"Plaintiffs overreached in seeking forced divesture of these key assets," Judge Mehta wrote, essentially telling DOJ prosecutors they swung for the fences and struck out.

Bull’s Take:

Google's regulatory overhang just lifted significantly without meaningful structural damage to its business model. For long-term investors, this ruling removes tail risk while preserving the company's core competitive advantages — a rare win-win in today's antitrust environment.

Market Stories of Note

Kraft Heinz Pulls a Kellogg: Food Giant Splits to Unlock Hidden Value:

The $25.8 billion food conglomerate is betting that two focused companies will command higher valuations than one sprawling empire, following the playbook of Kellogg's successful 2023 breakup that ultimately attracted premium buyout offers from Mars and Ferrero. The split separates Kraft Heinz's high-growth $15.4 billion condiments and sauces business from its slower $10.4 billion grocery staples division, allowing investors to pick their preferred risk-return profile rather than settling for a blended average. History suggests that when food companies shed their laggards and let their winners run, patient shareholders often get rewarded with acquisition premiums that make the initial stock decline look like a buying opportunity.

Salesforce's AI Pivot Moment: When Growth Darlings Face Their Reckoning:

Salesforce's brutal 25% decline this year creates the classic contrarian setup that patient value investors dream about — a dominant franchise trading at distressed multiples while rivals like Oracle command AI-boom premiums. The company's Agentforce platform already generates $100 million in annualized revenue just months after launch, suggesting Benioff's AI strategy may finally bridge the gap between hype and sustainable growth acceleration. Smart money is positioning for Wednesday's earnings to mark the inflection point where single-digit growth gives way to double-digit expansion, transforming today's laggard into tomorrow's comeback story.

CRYPTO

Fear & Greed

Headlines

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply