- The Investor Lookout

- Posts

- 📈 ASML's Growth Pause

📈 ASML's Growth Pause

AMD Resumes China AI Sales, Apple Invests $500M Rare-Earth, Bank of America Reports, BlackRock Hits $12.5T AUM, Trump Announces $90B Investments

Good morning.

⚡ The Fast Five → AMD Resumes China AI Sales, Apple Invests $500M Rare-Earth, Bank of America Reports, BlackRock Hits $12.5T AUM, Trump Announces $90B Investments

🔎 Market Trends → Nasdaq ends at another record high on Nvidia's China chip cheer; US Futures Dip Ahead of More Earnings, PPI Report

And now…

⏱️ Your 5-minute briefing for Wednesday, July 16, 2025:

MARKET BRIEF

Before the Open

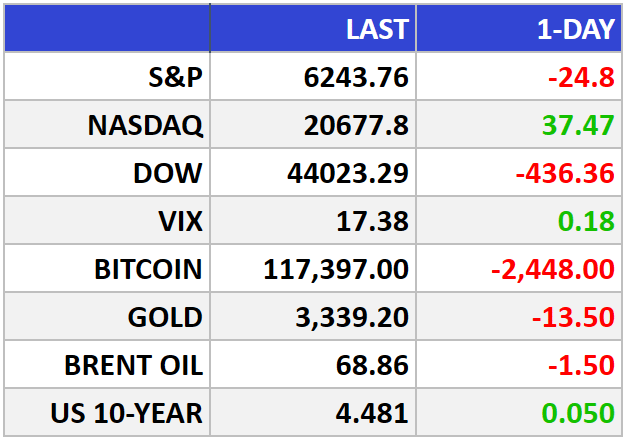

As of market close 07/15/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Nvidia Lifts Nasdaq to Record as Wall Street Weighs Inflation and Bank Earnings

Nasdaq gained 0.2% to close at 20,677.8, hitting another all-time high thanks to Big Tech. S&P 500 fell 0.4%, while the Dow sank 1% as financials and materials dragged broader indexes lower.

The Big Picture:

Markets stayed on edge Tuesday as inflation came in hot, yet not hot enough to derail bullish sentiment around AI and tech. Nvidia (NVDA) stole the spotlight, surging 4.0% after getting the green light to resume GPU exports to China.

Bank earnings delivered a mixed message: Citigroup (C) beat expectations and rallied, while Wells Fargo (WFC) and BlackRock (BLK) disappointed and dropped sharply. Treasury yields inched higher as investors priced in delayed Fed rate cuts, potentially into 2026, according to Morgan Stanley.

Meanwhile, tariff tensions remain loud but markets appear to be selectively tuning them out. President Trump’s latest target: Indonesia, slapped with a proposed 19% tariff.

Oil (WTI) edged down 0.5% to $66.66, while gold slipped 0.7%, suggesting a modest return to risk-on appetite.

Market Movers:

Nvidia (NVDA) +4.0%: Clearance to sell AI chips in China is a major win. Growth story extended.

Citigroup (C) +3.7%: Surged on a strong trading quarter and investment banking rebound.

Wells Fargo (WFC) -5.5% & BlackRock (BLK) -5.9%: Both fell on guidance cuts and revenue misses, stoking fears that net interest income may have peaked.

What They’re Saying:

“Loosening export restrictions provide upside and duration to Nvidia’s current growth cycle.”— William Stein, Truist Securities

WHAT WE’RE WATCHING

Events

Today: Bureau of Labor Statistics - Core Producer Price Index (PPI) for Final Demand m/m; Producer Price Index (PPI) m/m - 8:30am

Why You Should Care: Care It's a leading indicator of consumer inflation - when producers charge more for goods and services the higher costs are usually passed on to the consumer;

Earnings Reports

Today: Johnson & Johnson, Bank of America, United Airlines, ASML, Morgan Stanley, Goldman Sachs, Progressive, Prologis, PNC, Kinder Morgan, M&T Bank

Tomorrow : Netflix, PepsiCo, Abbott, GE Aerospace, Taiwan Semiconductor (TSMC), Novartis, U.S. Bank

MARKET BRIEF

Leading News

ASML's Growth Pause: A Speed Bump, Not a Roadblock

Photo Credit: Nurphoto | Nurphoto | Getty Images

Why it matters:

The world's most critical chipmaking enabler just hit the brakes on 2026 growth projections, but smart money sees opportunity in the uncertainty.

Zoom Out:

ASML (ASML-NL) delivered a solid Q2 beat with €7.7 billion in sales versus €7.52 billion expected, yet shares tumbled 6.5% on growth concerns. Classic market myopia at work—investors punishing a company for admitting what everyone already knew: geopolitical headwinds make forecasting treacherous.

The Dutch lithography giant's €5.5 billion in net bookings (vs. €4.19 billion expected) tells the real story. Customers aren't backing away; they're doubling down on the AI revolution that demands ASML's irreplaceable extreme ultraviolet machines.

CEO Christophe Fouquet's cautious 2026 outlook reflects prudent management, not fundamental weakness. When you're the sole supplier of tools needed for cutting-edge chips, temporary uncertainty doesn't erase your monopolistic moat.

Key Insights:

AI demand surge: High-end chips for artificial intelligence applications are driving "big" EUV demand, according to CFO Roger Dassen. This secular trend has years to run.

Next-gen advantage: ASML's new High NA tools—costing $400+ million each—represent the next frontier in chip manufacturing. One shipped in Q2, with more coming.

Tariff resilience: Trade tensions had "less negative" impact than feared, suggesting ASML's essential role transcends political theater.

Market Pulse:

"While we still prepare for growth in 2026, we cannot confirm it at this stage." —CEO Christophe Fouquet

Bull’s Take:

ASML's monopoly on advanced chipmaking tools makes it the ultimate AI infrastructure play. Today's selloff creates a buying opportunity for patient investors who understand that temporary guidance uncertainty doesn't diminish long-term dominance in the most critical technology.

Headlines

AMD cleared to join Nvidia and resume selling some underpowered AI chips to China (link)

Uber to roll out thousands of robo-cabs built by Baidu (link)

Apple commits $500M to US-based rare-earth recycling firm MP Materials (link)

Bank of America earnings are out (link)

BlackRock shares slump even as assets hit record $12.5 trillion on market rally (link)

Donald Trump touts $90bn in energy and AI investments at Pennsylvania event (link)

CRYPTO

Fear & Greed

Headlines

*Hat-tip to wallstmemes

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply