- The Investor Lookout

- Posts

- 📈 Adobe's Secret: Profits While Everyone Panics

📈 Adobe's Secret: Profits While Everyone Panics

This classic overreaction—21% stock decline meeting 11% revenue growth—rewards patient contrarians who ignore emotional noise.

Good Morning…

While Wall Street treats Adobe like a relic destined for the digital dustbin, the company just delivered another earnings beat that exposes the market's chronic inability to distinguish between temporary sentiment and enduring competitive advantages.

🔎 Market Trends → S&P 500 rally could continue for next few months, strategist says

🖥️ Market Movers from Fintech.tv → [WATCH] Navigating the Housing Market: Co-Ownership as a Solution in a High-Rate Environment

And now…

⏱️ Your 5-minute briefing for Friday, September 12, 2025:

MARKET BRIEF

Before the Open

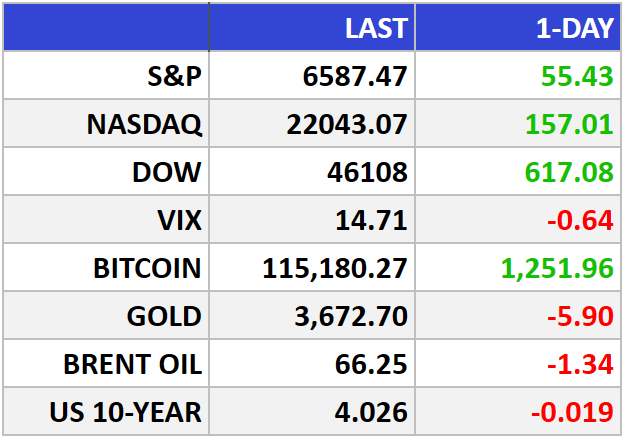

As of market close 09/11/2025.

Pre-Market

|

|

Fear & Greed

Markets in Review

Hot CPI, Cooler Yields: Rally Rolls to Records

Dow +1.36% to 46,108 (record). S&P 500 +0.85% to 6,587 (record). Nasdaq +0.72% to 22,043 (record).

The Big Picture:

Investors looked past a hotter monthly CPI (+0.4%) because the year-over-year pace stayed at 2.9% and core CPI +0.3% / 3.1% was as expected. Pair that with PPI −0.1% m/m and a jump in jobless claims (263k) and you get what the Fed needs to start cutting next week.

The real tell: 10-year Treasury yield slipped to ~4.0%. When the price of money cools, multiples breathe. Breadth improved, with financials (JPM) and consumer bellwethers (WMT) joining tech—classic late-cycle rotation that extends rallies.

Commodities stayed friendly. WTI crude in the low-$60s keeps input costs in check and cushions margins. That’s a quiet tailwind for earnings—and for the Fed.

Market Movers:

Banks like JPM rallied as lower yields steepen curves and ease credit jitters.

Micron (MU) popped on AI memory optimism; demand from data centers remains the fulcrum.

Opendoor (OPEN) +~80% on a new CEO catalyst—proof that leadership change still commands a premium in beaten-down cyclicals.

Warner Bros. Discovery (WBD) surged on deal chatter, reminding skeptics that M&A optionality can re-rate legacy media.

What They’re Saying:

“A quarter-point cut is a layup … watch the 10-year. If we see a 3-handle, the market could rip, ” says Jay Woods, Freedom Capital Markets.

WHAT WE’RE WATCHING

Events

Today: University of Michigan - Prelim UoM Consumer Sentiment - 10:00am

Why You Should Care: Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity;

Today: University of Michigan - Prelim UoM Inflation Expectations - 10:00am

Why You Should Care: Expectations of future inflation can manifest into real inflation, primarily because workers tend to push for higher wages when they believe prices will rise;

Earnings Reports

Today: There are no noteworthy earnings reports scheduled for release.

Monday: Dave & Buster’s, Toro

MARKET INSIGHTS

Leading News

Adobe's Earnings Beat Signals Creative Renaissance

Photo Credit: Rubaitul Azad

Why it matters:

Adobe's (ADBE) Q3 beat offers contrarian investors a chance to capitalize on excessive pessimism in a dominant franchise trading at its lowest valuation in years.

Zoom Out:

The market has been punishing Adobe with the ruthless efficiency of a rejection letter—shares down 21% year-to-date while the Nasdaq climbs 14%. Yet behavioral finance teaches us that when sentiment diverges this sharply from fundamentals, opportunity often lurks in the shadows.

Adobe just delivered its third consecutive earnings beat, posting $5.31 per share versus $5.18 expected, with revenue hitting $5.99 billion (up 11% year-over-year). Net income jumped to $1.77 billion, proving the creative software monopolist still prints money like a government mint.

The disconnect between performance and price reflects classic investor myopia—fixating on AI disruption fears while ignoring Adobe's fortress-like competitive moats.

Key Insights:

Creative Cloud dominance: Adobe's subscription model creates predictable cash flows that most CFOs would kill for, with switching costs higher than a Manhattan penthouse

AI integration advantage: Rather than being displaced by generative AI, Adobe is weaponizing it through Firefly and Creative Suite enhancements

Valuation opportunity: Trading at multi-year lows despite consistent execution suggests the market has overcorrected

Market Pulse:

"The street is treating Adobe like yesterday's newspaper when it should be viewing it as tomorrow's creative infrastructure," notes one veteran software analyst.

Bull’s Take:

Adobe's earnings resilience amid brutal sentiment creates a classic value trap that isn't actually a trap. Patient investors buying quality businesses at beaten-down prices rarely regret the decision.

Market Stories of Note

Paramount Makes Shocking Play for Warner Bros. Discovery:

This all-cash takeover bid matters because it signals media moguls finally recognize that their survival depends on scale, not stubborn independence in a streaming-disrupted landscape. While Warner Bros. Discovery (WBD) surged 28% on takeover speculation, savvy investors should note that Paramount Skydance's aggressive expansion mirrors the consolidation playbook that historically rewards patient shareholders who buy before the obvious becomes inevitable. The real opportunity lies in recognizing that media's fragmented mess is creating the same forced selling and irrational pricing that turned railroad consolidation into generational wealth a century ago.

Winklevoss Twins Score $3.3B IPO Victory:

Gemini's successful public debut matters because it signals institutional appetite for crypto infrastructure companies is finally maturing beyond speculative frenzy into legitimate financial services territory. The IPO priced at $28 per share—above the revised $24-26 range—despite the company burning through $283 million in just six months, proving that investors are betting on exchange economics rather than current profitability in this still-adolescent sector. Smart money should note that Nasdaq's $50 million strategic investment suggests traditional finance titans view crypto exchanges as essential infrastructure rather than speculative sideshows, making GEMI a potential bridge play for cautious investors seeking crypto exposure without the volatility.

SPONSORED

Company Spotlight

Keep this stock on your watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

Created by a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions & service fees across 2,000+ owners. That’s good for more than $110M in gross profits in less than 5 years.

No surprise the same firms that backed Uber and Venmo already invested in Pacaso. But you don’t have to be a Wall Street firm to invest. Pacaso is giving the same opportunity to everyday investors, and 10,000+ people have already joined them.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

CRYPTO

Fear & Greed

Headlines

All content provided by Investor Lookout and Bull Street is for informational and educational purposes only and should not be taken as trading or investment recommendations.

Reply